When I got my first job post-college, I couldn’t believe how much money I was about to make. I had dreams of buying a car, living in a fabulous apartment, and generally enjoying life with no money worries. That is: Until my mom sat me down in front of a spreadsheet and made me create a monthly budget. I was absolutely crushed as I created a line-by-line budget detailing out how little I could spend on things like groceries, social activities, and the gym. Instead of a car, I ended up with a monthly bus pass. Rather than a fabulous apartment, I slept in the dining room of an apartment that didn’t have heat.

I spent the next couple of years trying to stick to this strict budget but failed more months than I succeeded. I thought it was because I was bad with money or because I lacked the discipline to stick to my crazy, restrictive budget but I later learned that only 32% of Americans use a budget to track their expenses each month. Why? Because traditional budgeting is broken.

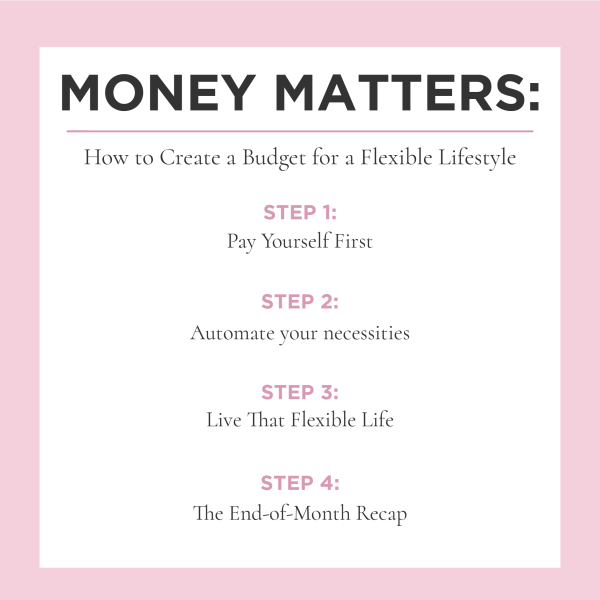

After some trial and error, I found a system that gave me the flexibility to choose how to spend my money each month—a flexible, automated spending plan. The basics of this plan are: If you automate the important things at the beginning of the month (your bills and savings), you’re free to spend the rest of your money however you choose for the rest of the month. Buy yourself a latte every single day? Head out on a last-minute weekend trip with friends? You can choose what to spend your money on with zero guilt. It takes time to set up, but once it’s up and running, you can manage your money in just a few minutes each month. Here’s how to do it:

Before you jump into creating your flexible spending plan, there are a few things that you should know: How much your take-home is, how much you currently save and invest, and what your fixed costs (rent, commute, debt payments) are each month.

If you have no idea what these numbers are, don’t overthink it. Just log into your bank account and credit card and quickly make a list of those things. Don’t forget to include any necessities that you pay annually or semi-annually, like car insurance.

You’ve worked hard and hooray, it’s payday! The very first thing to do is pay yourself first, which means putting money—between 10 to 20% of your after-tax income—directly into savings and investment accounts before you do anything else.

This includes automatic transfers to your employer’s retirement plan (like a 401K), or transfers to a separate retirement account, like a Traditional or Roth IRA, as well as any transfers that you make into savings accounts, like your emergency fund, house down payment, vacation fund, or anything else that you feel compelled to save for. By doing this first and making it automatic, you can live that guilt-free flexible life for the rest of the month. You won’t have to decide at the end of the month if you’re going to put money into that IRA or meet up with friends for brunch.

Not even close to that 10 to 20% saving mark?

Start where you are. How much are you currently able to set aside for saving and retirement? Set up an automatic transfer for that amount. Next month, increase it by 1% and continue regular 1% increases until you’ve reached your limit on what you can save.

For example, say your take-home pay is $5,000 and right now you’re saving and investing 5% a month, or $250. Next month, try increasing that to 6%. That’s going to take you from saving $250 to $300 per month. By changing the amount you save gradually, you’ll barely feel the change.

Separate your savings.

Rather than making one transfer to a vaguely defined savings account, try setting up a savings account for every goal that you have. It makes it fun and easy to track your progress and when you’re ready to use that money you’ve set aside, you can do so guilt free.

My husband and I have anywhere from 5 to 10 savings accounts set up for a number of different goals that we’re looking forward to: a new car, our summer vacation, home improvements, emergency savings, and an account we’ve affectionately named our “f-it fund” for big (exciting) things like moving cities or pursuing a new career path. We use CapitalOne 360 because we can have up to 25 savings accounts and there are no minimums or monthly fees, but investment sites like Ellevest and Qapital (for short-term goals) are also great options.

Once you’ve paid yourself, it’s time to pay everyone else! To make it easy, let’s say you get paid once a month on the 1st. You’ve done step 1 and paid yourself first. Winning. Now, set up your bills to be paid automatically during the first week of the month. Everything that you must pay gets paid immediately: your rent/mortgage, debt payments, utilities, gym membership, etc.

How does this help? It gives you both predictability and freedom. Since you’ve taken care of all of your known responsibilities during the first week of the month, you have the freedom to spend the rest however you choose. No more random internet bill popping up at the end of the month, making you feel guilty for buying the good cheese for girls night.

Take the time to reassess.

Take some time to look through your monthly bills and make sure you still really need what you’re paying for. Things like that $20/mo fitness app that you loved for a month but haven’t opened in 3 months? Cut it. Use this as an opportunity to spring-clean your bills.

Plan for irregular bills.

Do you have a bill that pops up once or twice a year, like car insurance? Divide your total bill into monthly payments and make automatic transfers into a savings account designated to pay that bill. If your car insurance is $600 a year, set up a monthly recurring payment of $50 to a savings account for that bill. When that bill is due, you have the money ready and waiting to make that payment.

Plan for unexpected bills.

Even with the best planning, there are some bills that you won’t see coming. Last month my (adorable) dog ate something toxic and I spent the evening, and $300, in the vet’s office. For unexpected moments like these, set up a slush fund. We automatically transfer a small amount of money each month into a separate account to cover unexpected bills like this. We treat payments into this slush fund just like any other bill—only we’re not sure what we need it for yet.

This is where your flexibility to live comes to life. You can use the remaining money in your account to spend however you want for the remainder of the month—no set budget designates how often you can eat out. No bucket that dictates whether you can afford spin classes. You can spend any way you choose—as long as you aren’t spending more than you have (hello, credit cards)—knowing that your responsibilities have been automatically taken care of at the beginning of the month.

Spend on things that make you happiest

To make sure I get the most bang for my buck, I focus on buying the things that make me happiest. What makes me happiest will change day to day and week to week, but before I get ready to buy anything I pause and ask, “Does this make me really happy?” Yes? I’ll gladly spend on it. If I waver, I put it down.

Set limits if you need them

If you find yourself running wild with your new-found flexibility, only to survive off ramen for the last five days of the month, you may want to set yourself weekly spending limits to help you ease into this freedom. If, for example, after step 1 and 2 you have $1,200 remaining for the month, you would set yourself a weekly spending limit of $300. Whether you choose to go out for Happy Hour drinks or stock up on artisan cheese at the weekend farmer’s market, once you’ve spent your money for the week, you’re done. You can set weekly spending limits by mentally keeping track of your balance, by using only cash for your spending, or by setting a weekly goal in the app Qapital.

Once you have this system in place, you’ll still want to check in on your money at the end of each month. You can celebrate your small victories (look at all that money you put into savings!), check in on your purchases (are you happy with what you spent your money on?), and adjust as needed (did you get stuck eating ramen for the last 5 days of the month?).

This plan isn’t meant to be overly rigid, but rather help you find the right spending rhythm that not only enables you to save but helps you enjoy how you spend your money.